how to calculate nj taxable wages

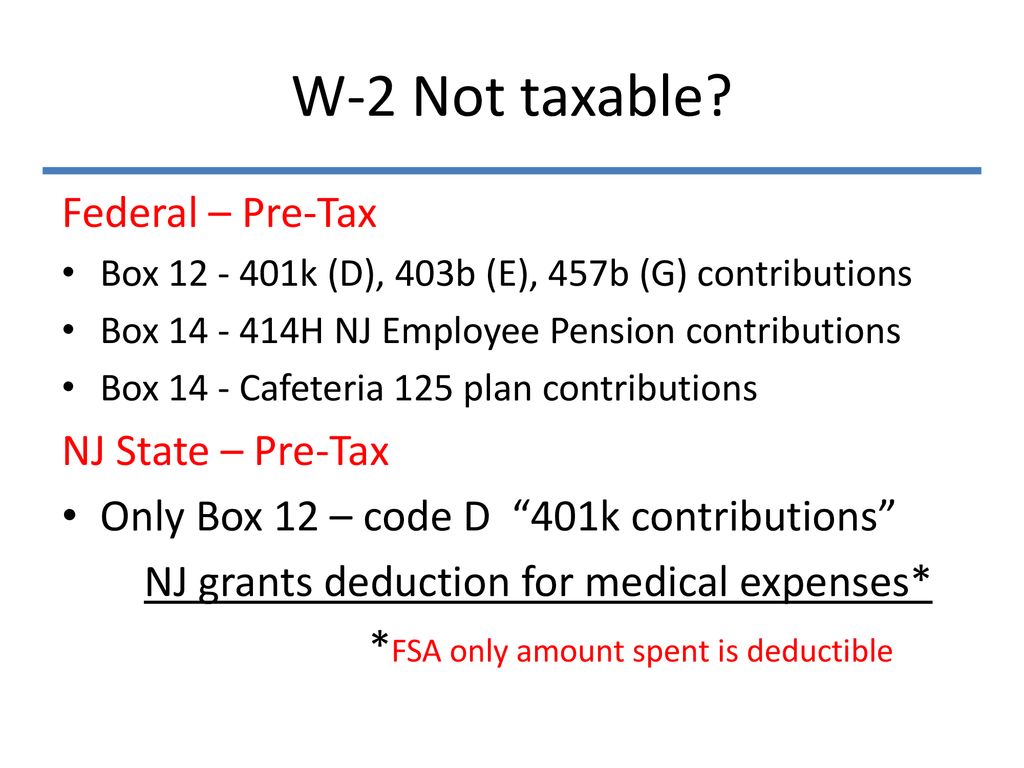

Because of these and other differences you must take the amount of wages from the State wages box on your W-2s Box 16. Total Taxable Wages are all taxable wages reported to the New Jersey Department of Labor by all.

Taxable Retirement Income.

.jpg)

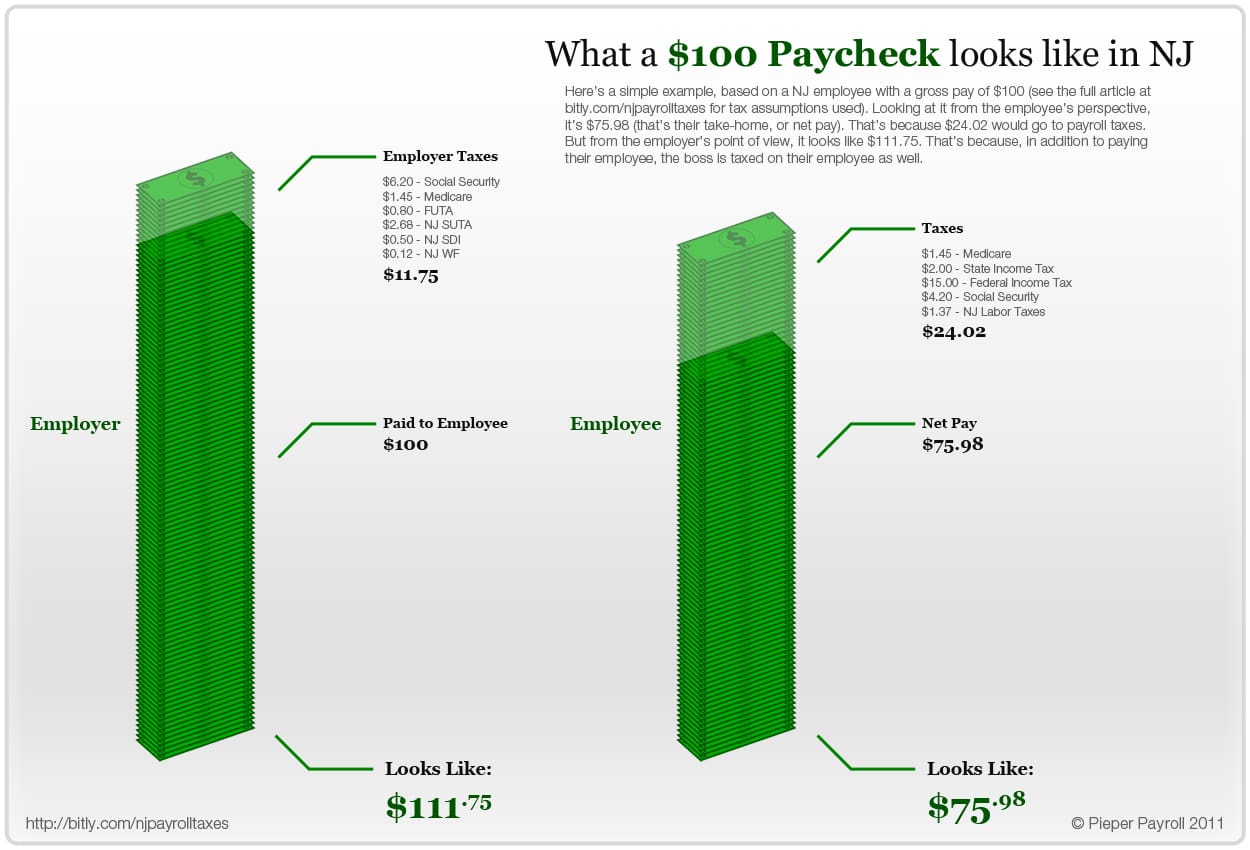

. Switch to New Jersey hourly calculator. Press Calculate to see your New Jersey tax and take home breakdown including Federal Tax deductions How to use the advanced New Jersey tax calculator Enter your income. Use the resulting wage figure to calculate the correct withholding amount.

Tax to be withheld is. Also check your W-2 to confirm that New Jersey or NJ appears in the State box. But can be used to reduce taxable income in New Jersey.

Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey paycheck calculator. For examples of how to calculate the tax credit on businessnonwage income Purpose of the Credit This credit minimizes double taxation of income that is already taxed by other jurisdictions. Balance of Unemployment Trust Fund is the balance in the Fund as of March 31st of the current year.

To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Calculate hourly employees wages by multiplying the number of hours worked by their pay rate including a higher rate for any overtime hours worked. Here is the formula for calculating taxable wages.

How your new jersey paycheck works. The suta limit also called a suta wage base is the. Figure out your filing status.

CALCULATE TAXABLE WAGES 2 Add any bonuses or taxable fringe benefits. New Jersey income tax rate. Your income from wages net profits from business distributive share of partnership income and net pro rata share of S corporation income totals 3000 or less.

Gross earnings includes taxable fringe benefits and tips minus. If the amount of taxable The amount of income wages is. Essex Ct Pizza Restaurants.

Amounts received as early retirement benefits and amounts reported as pension on Schedule NJK-1 Partnership Return Form NJ-1065 are also taxable. How to Calculate Salary After Tax in New Jersey in 2022 Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs Choose your filing status. Days worked in New Jersey Total days worked all year X Total wages for the year Wages earned in New Jersey If you have a record of the exact amount of income earned from work in New Jersey you should only withhold on that amount.

New jersey state standard deduction 1 x 100000 100000 13400000. The social security wage base for 2019 was 132900. Income Tax Rate Indonesia.

Heres a general guide to how to calculate taxable wages. Soldier For Life Fort Campbell. How To Calculate Nj Taxable Wages.

Check the box - Advanced NJS Income Tax Calculator Confirm Number of Dependants Confirm Number of Children you claim Tax Credits for. Using our New Jersey Salary Tax Calculator. 134900 in accordance with njac.

Over But Not Over Of Excess Over 0 385 15 0 385 673 577 20 385 673 769 1154 39 673 769 1442 1529 61 769 1442 9615 5635 70 1442. Your credit will either. Gross wages - Non-taxable wages - Pre-tax deductions Taxable benefits Taxable wages The best payroll software tools that calculate.

Opry Mills Breakfast Restaurants. Bonuses tips and commissions also get included in gross wages. The Unemployment Trust Fund reserve ratio is calculated as follows.

If youre receiving a bonus on the check that will need to be added to your basic gross pay and considered in the taxable wages calculation. Enter your annual income in New Jersey. Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from the private sector and Keogh plans.

Calculate salaried employees paychecks by dividing their salary by the number of pay periods per year. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator. New Jersey Income Tax Calculator 2021.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income. The State Wages figure on your W-2 s from employment outside New Jersey may need to be adjusted to reflect New Jersey tax law. Restaurants In Matthews Nc That Deliver.

Your total income for the entire year was 150000 or less. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Majestic Life Church Service Times.

After a few seconds you will be provided with a full breakdown of the tax you are paying. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. March 1 2022.

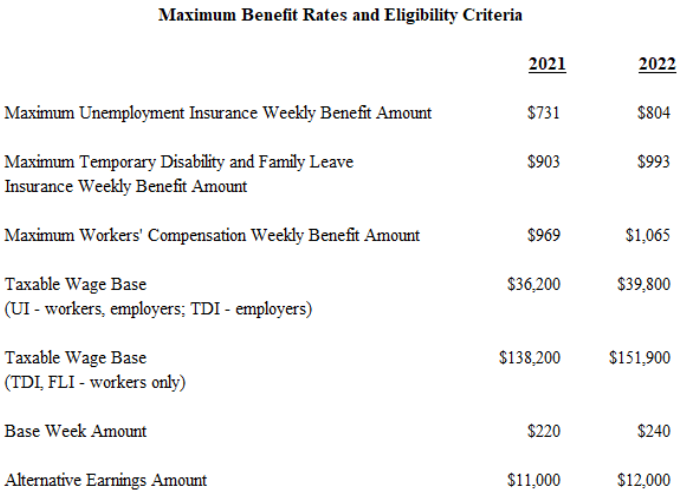

Census Bureau Number of cities with local income taxes. Balance of Unemployment Trust Fund total taxable wages Unemployment Trust Fund reserve ratio. You andor your spousecivil union partner if filing jointly were 62 or older on the last day of the tax year.

New Jersey Paycheck Quick Facts. The filing status affects the Federal and State tax tables. If fringe benefits are being reported such as GTL or auto-allowances.

2022 Federal Payroll Tax Rates Abacus Payroll

How Is The Net Investment Income Tax Niit Calculated

2019 New Jersey Payroll Tax Rates Abacus Payroll

Solved Remove These Wages I Work In New York Ny And

Employee Compensation Ppt Download

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

Understanding W 2 Box 1 Federally Taxable Wages Tips And Other Compensation Line 7 On 1040 Box 2 Federal Income Tax Withheld Line 64 On 1040 Box Ppt Download

Solved New Jersey Non Resident Tax Calculating Incorrectl

Understanding W 2 Box 1 Federally Taxable Wages Tips And Other Compensation Line 7 On 1040 Box 2 Federal Income Tax Withheld Line 64 On 1040 Box Ppt Download

2021 New Jersey Payroll Tax Rates Abacus Payroll

Solved Remove These Wages I Work In New York Ny And

Solved I Live In Nj But Work In Ny How Do I Enter State

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

2020 New Jersey Payroll Tax Rates Abacus Payroll

Aatrix Nj Wage And Tax Formats

New Jersey Nj Tax Rate H R Block